Are you tired of missing out on the next big stock market winner? 💹

Imagine having the power to uncover hidden gems before they skyrocket. 🚀

Dive into our guide on the best stock analysis software of 2023, tailored to help you maximize returns and stay ahead in the ever-evolving financial markets. 🌐

🗝️ Key Benefits of Using Stock Analysis Software in Investing

In-Depth Analysis

These tools provide comprehensive data on stocks, including historical performance, financial statements, earnings reports, and more. This wealth of information allows you to conduct a thorough fundamental analysis, essential for long-term investment strategies.

Market Trends and Patterns Identification

For technical traders, stock analysis software comes equipped with various technical indicators and charting tools. These features help in identifying market trends, patterns, and potential entry and exit points, which are crucial for short-term trading strategies.

Time Efficiency

Manually analyzing stocks can be time-consuming. Stock analysis software automates many aspects of the analysis process, saving you valuable time and allowing you to focus on making informed decisions.

Accessibility to Expert Insights and Analyst Ratings

Many stock analysis platforms provide access to professional analysts’ reports and ratings. This can offer valuable insights, especially for investors who may not have the time or expertise to analyze every detail themselves.

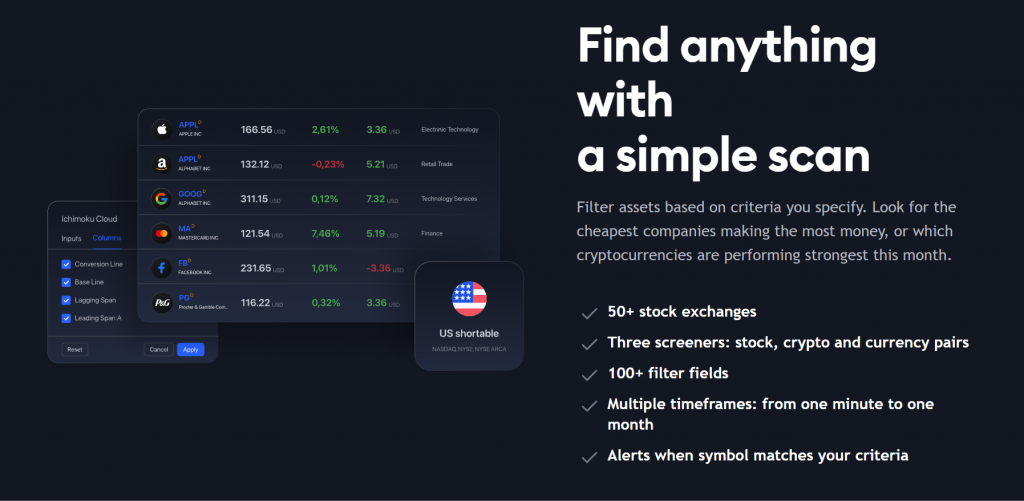

Customizable Screening Tools

These tools allow you to filter stocks based on specific criteria, such as market cap, sector, dividend yield, price-to-earnings ratio, etc. This helps in quickly identifying stocks that meet your investment criteria.

💥 5 Advanced Stock Analysis Software to Empower Your Investing

| Feature | WallStreetZen | Seeking Alpha | TrendSpider | TradingView | Thinkorswim |

|---|---|---|---|---|---|

| Fundamental Analysis | ✓ | ❌ | ✓ | ❌ | ❌ |

| Technical Analysis | ❌ | ❌ | ✓ | ✓ | ✓ |

| Investment Research | ✓ | ✓ | ❌ | ❌ | ✓ |

| Stock Pickers/Analysts | ✓ | ✓ | ❌ | ❌ | ✓ |

| Stock Screener | ✓ | ✓ | ✓ | ❌ | ❌ |

| News and Quote Data | ✓ | ✓ | ✓ | ✓ | ✓ |

| User-Friendly Interface | ✓ | ❌ | ✓ | ✓ | ✓ |

| Advanced Charting | ❌ | ❌ | ✓ | ✓ | ✓ |

| Portfolio Management | ❌ | ❌ | ✓ | ❌ | ✓ |

| Real-Time Data | ✓ | ❌ | ✓ | ✓ | ✓ |

| Ease of Use | User-Friendly | Complex Interface | Intuitive | User-Friendly | Complex Interface |

| Learning Curve | Low | Moderate | Moderate | Low | Moderate |

WallStreetZen

WallStreetZen stands out as a premier choice for fundamental investors seeking an edge in the market. Designed for the serious yet part-time investor, this stock analysis software excels in aggregating the latest financial data and performing deep, automated fundamental analysis.

It distills complex financial information into simple, one-line explanations, enabling investors to grasp the fundamental strengths and weaknesses of any stock quickly.

Unique features like the Zen Score offer a rapid, comprehensive overview of a company’s fundamentals, facilitating informed investment decisions.

Additionally, WallStreetZen tracks and ranks stock analysts based on their historical performance, providing users with access to expert insights and top stock picks. Ideal for investors focused on long-term value and growth, WallStreetZen merges efficiency with depth in analysis.

📌 Exclusive Features That Set WallStreetZen Apart in Stock Analysis

Analyst Performance Tracking

WallStreetZen sets itself apart by tracking the historical performance of nearly 4,000 global analysts. This feature allows users to follow and rely on the advice of analysts who have a proven track record of success, offering a unique edge in stock selection.

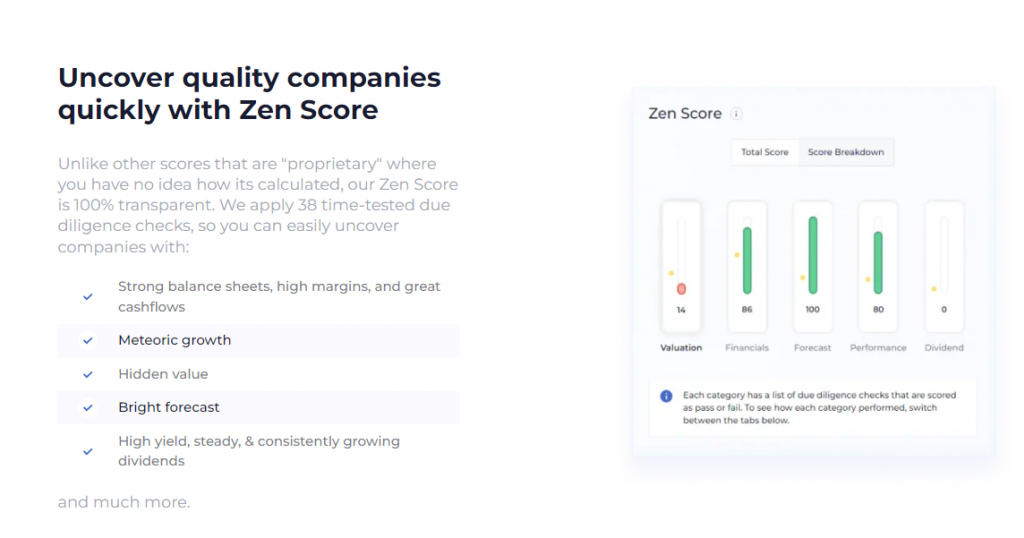

Zen Score

Exclusive to WallStreetZen, the Zen Score provides a quick, comprehensive summary of a company’s fundamental health. This proprietary scoring system evaluates companies across multiple dimensions, giving investors an instant high-level overview before delving into deeper analysis.

Simplified Financial Explanations

One of WallStreetZen’s standout features is its ability to convert complex financial data into simple, understandable one-liners. This approach demystifies financial analysis for part-time investors, making it easier to make informed decisions without getting overwhelmed by data.

Pre-Built Stock Ideas

WallStreetZen offers a library of pre-built stock ideas, helping users to quickly identify potential investment opportunities without needing to start from scratch. This feature is especially useful for investors who are looking for inspiration or a starting point for their research.

Customizable Stock Screener

Unlike many other platforms, WallStreetZen’s stock screener includes both quantitative and qualitative criteria. This allows users to tailor their search to match personal investment preferences and strategies, making it a highly versatile tool for a range of investing styles.

Pros And Cons

👍 Pros

- Data-Driven Decision Making: Leverages the latest financial data for informed choices.

- Global Analyst Insights: Access to a wide range of international market experts.

- Regular Updates: Ensures you’re working with the most current market information.

- Custom Alerts: Stay informed with personalized notifications on stock movements.

👎 Cons

- Lacks technical analysis tools, not ideal for day traders.”

- Subscription-based, may not suit budget-conscious investors.

Seeking Alpha

Seeking Alpha stands out in the investment community for its unique, crowd-sourced approach to stock analysis. This platform differentiates itself by featuring a diverse array of investment articles and blogs, authored by both amateur and professional analysts. These contributions provide a rich spectrum of perspectives, offering insights into potential buy, sell, or hold decisions.

Users can follow their preferred authors, receiving tailored notifications on new analyses and recommendations. The platform encourages active engagement, enabling users to interact with and evaluate the rationales behind different investment strategies.

While Seeking Alpha caters primarily to investors seeking expert opinions and market insights, it also offers fundamental data and tools, albeit more as a backdrop to its robust, community-driven content.

📌 Distinctive Features of Seeking Alpha: Enhancing Investment Strategies

Author Following System

Unique to Seeking Alpha, users can follow specific authors, allowing for a personalized feed of investment ideas and analyses based on preferred investment styles or sectors.

Crowdsourced Content Quality

Seeking Alpha’s platform stands out with its crowdsourced content, where the quality and popularity of an author’s contributions are organically determined by the community, offering a wide range of perspectives.

Transparent Analyst Performance

The platform provides transparency in its analysts’ track records, allowing users to see the historical accuracy and performance of recommendations, adding a layer of trust and reliability.

Community Discussion Forums

Seeking Alpha offers interactive forums where users can discuss articles, share insights, and debate investment strategies, fostering a collaborative environment for idea generation and learning.

Earnings Call Transcripts

A distinctive feature of Seeking Alpha is the availability of earnings call transcripts for numerous companies, providing users with direct access to management discussions and insights that are crucial for informed investment decisions.

Pros & Cons

👍 Pros

- Extensive Research Database: Access to a vast library of financial articles and in-depth analyses.

- Real-Time News and Updates: Keeps investors informed of the latest market news and stock movements.

- User-Generated Watchlists: Customizable lists to track and monitor preferred stocks and sectors.

- Diverse Investment Opinions: Exposure to a wide range of viewpoints, aiding in well-rounded decision-making.

👎 Cons

- Content variability: Quality and accuracy can vary with user-generated articles.

- Premium Subscription Required: Full access to features necessitates a paid subscription.

TrendSpider

TrendSpider stands out in the realm of technical analysis with its innovative approach to chart analysis and market trend identification. It is designed for traders who prioritize technical over fundamental analysis.

TrendSpider automates the process of drawing trendlines and identifying support and resistance levels, significantly reducing manual effort and the potential for human error.

The platform offers advanced charting capabilities, including a multitude of technical indicators and different chart types, catering to the needs of both novice and experienced traders.

Furthermore, its unique dynamic price alerts and backtesting features enable traders to test strategies against historical data.

TrendSpider’s user-friendly interface and real-time data analysis make it a go-to tool for traders focusing on short-term price movements and patterns.

📌 Revolutionizing Trading with TrendSpider: Unique Technical Analysis Features

Automated Technical Analysis

TrendSpider uniquely automates the drawing of technical analysis patterns and trendlines, saving traders significant time and reducing subjective interpretation.

Dynamic Price Alerts

The platform offers advanced alerting capabilities that are based on technical analysis criteria, not just price. These alerts adapt to changing market conditions, providing timely and relevant notifications.

Market Scanner

TrendSpider features a powerful market scanning tool that allows traders to scan the market for specific technical conditions and setups, making it easier to identify potential trading opportunities quickly.

Multi-Timeframe Analysis

A standout feature is its multi-timeframe analysis capability, allowing traders to overlay multiple timeframes on a single chart. This provides a comprehensive view of both short-term and long-term trends.

Raindrop Charts

TrendSpider introduces the innovative “Raindrop Chart,” a unique visualization tool combining price action and volume, offering a more nuanced view of market sentiment than traditional candlestick charts.

Pros & Cons

👍 Pros

- Efficient Strategy Planning: Streamlines analysis with automated tools.

- Comprehensive Market Coverage: Offers wide-ranging data for diverse assets.

- Enhanced Decision Making: Integrates volume with depth price.

- Seamless Integration: Compatible with various data feeds and platforms.

👎 Cons

- Focused on Technical Analysis: Limited utility for fundamental investors.

- Lacks Fundamental Analysis: Not ideal for investors focused on company financials and valuations

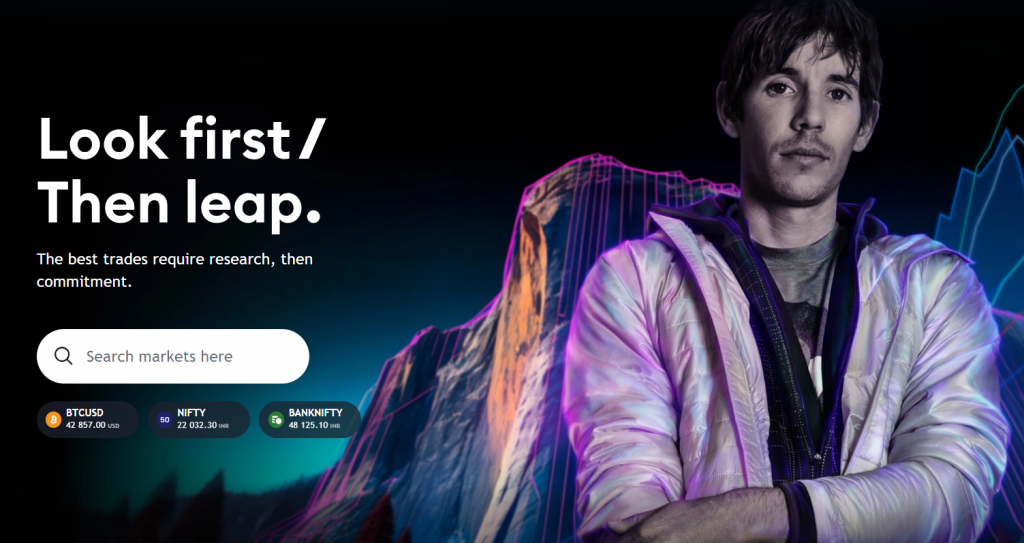

TradingView

TradingView is renowned in the trading community for its exceptional charting and social networking features, catering primarily to technical analysts and traders.

It stands out with its vast array of charting tools and indicators, making it a go-to platform for detailed technical analysis. Users appreciate its real-time data streaming, which covers a wide range of markets including stocks, forex, and cryptocurrencies.

TradingView’s collaborative aspect is notable; it allows users to share trading ideas and strategies within an active community, fostering learning and exchange of insights.

Its user-friendly interface appeals to both novices and experienced traders. Additionally, TradingView’s multi-platform accessibility ensures that users can track markets and their portfolios on the go.

📌 Unique Selling Points: Why TradingView Excels in Market Analysis

Social Trading Features

TradingView uniquely integrates social networking within its platform, allowing traders to share charts, ideas, and strategies, and follow other traders, fostering a collaborative trading environment.

Paper Trading Functionality

It offers a paper trading feature where users can practice trading strategies in a risk-free environment using virtual funds, which is excellent for beginners and for testing new strategies.

Customizable Scripting Language

TradingView provides Pine Script, a user-friendly programming language that allows users to create and share their own custom indicators and trading strategies.

Extensive Market Coverage

TradingView supports a wide array of asset classes including stocks, forex, cryptocurrencies, futures, and indices, making it a comprehensive tool for diverse market analysis.

Advanced Technical Analysis Tools

The platform stands out with its vast selection of over 100 pre-built technical indicators and tools, combined with the ability for users to create their own, offering unparalleled flexibility in technical analysis.

Pros & Cons

👍 Pros

- Cross-Platform Accessibility: Trade on the web, desktop, and mobile.

- Real-Time Global Data: Instant access to worldwide markets.

- Extensive Alert System: Customizable notifications for market changes.

- Community-Driven Insights: Gain from collective wisdom and trends.

👎 Cons

- Occasional Lag: May experience delays during high traffic.

- Lack of Customer Support: Limited assistance for troubleshooting issues.

Thinkorswim

Thinkorswim, developed by TD Ameritrade, is a comprehensive trading platform renowned for its robust tools and features. It caters primarily to active traders and investors seeking advanced charting, analysis options, and real-time data.

The platform offers an array of assets including stocks, options, futures, and forex.

Users benefit from customizable charts, a range of technical indicators, and a suite of drawing tools for in-depth market analysis. Thinkorswim also includes paper trading capabilities, allowing users to practice strategies without financial risk.

The platform is accessible via desktop, web, and mobile applications, providing flexibility and convenience for trading on the go.

📌 Unique Features of Thinkorswim That Set It Apart in the Trading Platform Market

Paper Trading Functionality

Thinkorswim’s paper trading feature stands out in its segment. It allows users to simulate trading with virtual money, providing a risk-free environment to practice strategies, test market theories, and learn the platform without any financial risk.

This feature is especially beneficial for beginners and those looking to refine their trading techniques.

Advanced Charting and Analysis Tools

The platform offers a comprehensive suite of advanced charting and technical analysis tools. Users can access a wide range of technical indicators, drawing tools, and customizable charting options.

These tools cater to detailed market analysis, making it easier for traders to identify trends, patterns, and potential trading opportunities.

Extensive Asset Coverage

Thinkorswim provides access to a diverse range of asset classes including stocks, options, futures, and forex markets. This extensive coverage enables traders to diversify their portfolios and explore various market segments, all within a single platform.

Elite-Level Market Scanners

Thinkorswim excels with its elite-level market scanners, which allow users to efficiently sift through vast amounts of market data to identify trading opportunities.

These scanners can be customized with specific criteria and filters, enabling traders to focus on stocks, options, or other securities that meet their investment strategies.

This feature is particularly useful for traders looking to maximize their time and pinpoint relevant market movements quickly.

Comprehensive Risk Analysis Tools

The platform stands out for its comprehensive risk analysis tools, essential for managing and understanding the potential risks associated with different trading strategies.

These tools help traders assess the risk exposure of their portfolios, evaluate the potential impact of market changes, and make more informed decisions.

This focus on risk management is a critical aspect that appeals to both conservative investors and aggressive traders, offering a balanced approach to trading.

📈 Choosing the Right Stock Analysis Software for Your Investment Style

WallStreetZen

Best for: Novice investors or those looking for simple fundamental analysis.

Why: WallStreetZen offers a user-friendly interface and basic fundamental analysis, making it suitable for beginners.

Seeking Alpha

Best for: Investors interested in stock analysis from a community of contributors.

Why: Seeking Alpha provides insights from a range of stock pickers and analysts, making it suitable for those who value diverse opinions.

TrendSpider

Best for: Technical traders who rely on chart analysis.

Why: TrendSpider excels in technical analysis and charting, making it a strong choice for traders who focus on technical indicators.

TradingView

Best for: Traders and investors seeking advanced charting and technical analysis tools.

Why: TradingView offers comprehensive technical analysis features and a wide range of charting tools, making it suitable for active traders.

Thinkorswim

Best for: Active traders and those who value in-depth research.

Why: Thinkorswim is a robust platform offering advanced charting, research, and portfolio management tools, making it ideal for active traders and investors who need comprehensive analysis.

🔥 Bottom Line

In conclusion, stock analysis software plays a pivotal role in assisting investors to make informed decisions, optimize their portfolios, and stay ahead in the dynamic world of trading.

These platforms offer unique features catering to diverse investment styles. Among the options mentioned, “TradingView” stands out for its versatility and comprehensive tools, making it our top recommendation.

However, the choice ultimately depends on your specific investment goals and preferences. Explore the features of each software and select the one that aligns best with your trading strategy and needs.

Happy investing!