Everyone inside and out of the crypto community is well aware and familiar with the concept of the volatility of digital assets.

The dips and the highs in the value of cryptocurrencies are a daily thing and to exploit the market conditions in order for it to be profitable for you, one needs to work around the clock, which to be honest, is not feasible.

So, how about having a bot which you can either make from scratch or use already written investment algorithms, so that they work the same way you do when making a trade.

This is where 3Commas platform shines, how? We’ll get into the details in this 3Commas Review.

3Commas Review: Overview

3Commas is a cryptocurrency trading platform that offers business investment tools for both beginners and expert investors in order to generate profitable trades.

3commas have been in the market since 2017 with an average monthly trading volume of $22.5 Billion with $1.2 billion trades done via the platform till date. It currently supports over 10 crypto exchanges, offers a mobile application, and provides tools like automated bots, trading interface, smart trade, portfolios, crypto signals, live charts and many more.

Getting started with 3Commas

Before one can start with their trading activities, a 3Commas account has to be created. Users can do either of the following; fill out the form asking for Email id and password, use Apple id or Facebook credentials.

Once the account is verified, users need to link their 3Commas account with crypto exchanges. This is mostly done via extracted API keys from the exchanges.

Users can do trade transactions manually or via automated bots once the exchanges are linked successfully.

Pricing Plans

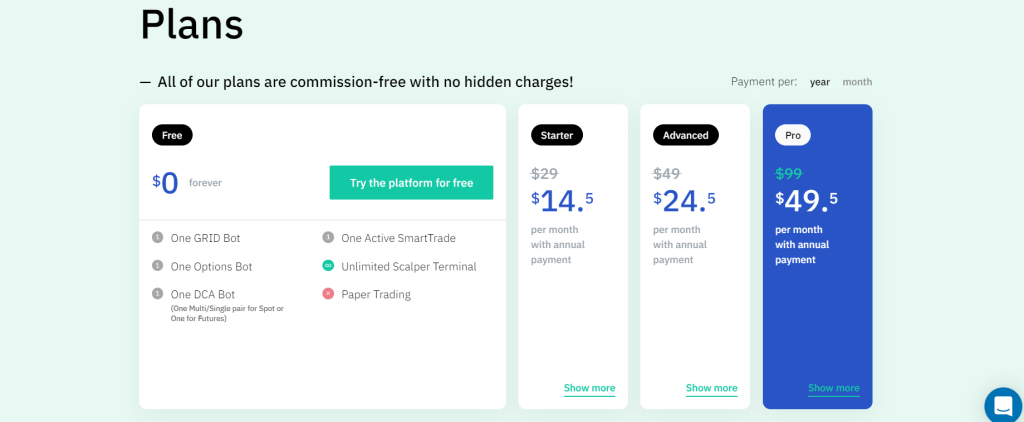

3Commas offers three paid plans on a yearly and monthly subscription basis. The platform however, also offers a free plan which allows traders to try a limited number of services without any charges. It also offers a 3-day free trial for all the users with pro plan features.

3Commas does not charge any commission or hidden fees on the trade. All the plans include support to 18 exchanges, consolidated portfolio, multi-level referral program, free mobile application, TradingView integration, trailing, stop-loss, take-profit and over 15 additional trading features.

It accepts payments via Visa, Mastercard, PayPal and cryptocurrencies. The starter plan costs $29 on monthly and $14.5 on yearly basis. It includes all the basic perks along with unlimited active Smart Trades, Scalper terminal and limited number of bots that one can use.

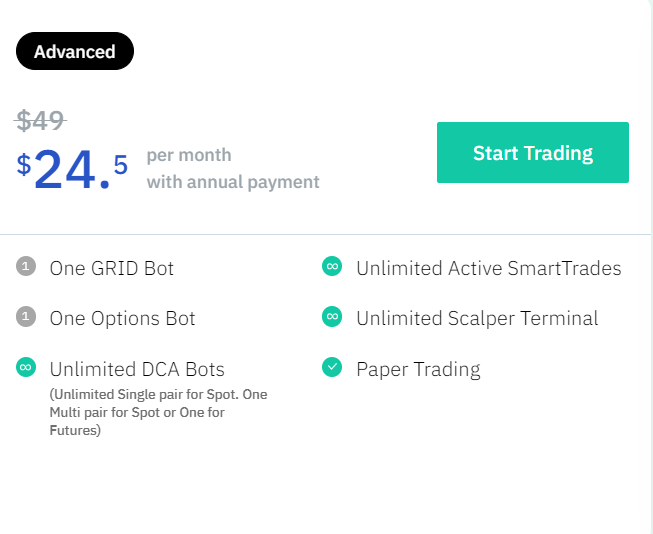

The advanced plan costs $49 on monthly and $24.5 on yearly basis. It offers basic features along with unlimited active Smart Trades, paper trading, Scalper terminal, dollar-cost bots and one grid and options bot each.

Beginners can subscribe to this plan in order to get familiar with the platform as well as crypto markets without having to risk their funds by using paper trading. The pro plan costs $99 on a monthly and $49.5 on yearly basis. It provides an unlimited number of automated bots, paper trading, SmartTrades, Scalper terminal along with additional features.

Crypto Exchanges Supported

3commas currently supports 18 crypto exchange platforms. Some of the popular crypto exchanges available are Binance, Gemini, BitFinex, Gate.io, Kraken, Coinbase Pro, etc.

3Commas Features

So far, we know from this 3Commas Review that the platform offers an ample number of features and tools that have great potential to generate financial profits as well as enable users to gain insights and expertise in the crypto markets. Let’s dive into them and see how each feature is helpful for investors.

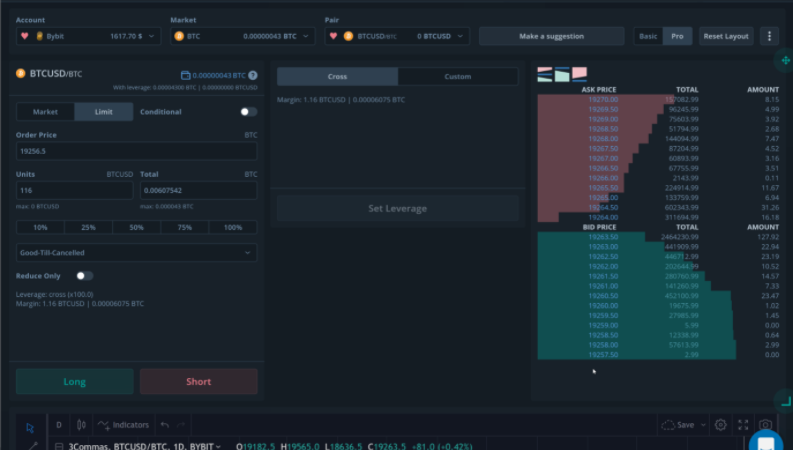

Trading Terminal

3Commas provides a dynamic trading terminal which provides advanced tools through which users can manage multiple exchange accounts from one interface. Users can customize the trading terminal according to their needs. It offers the following:

- Concurrent profit take & stop loss

- Market orders which execute a deal with the highest bid once the limit is reached.

- Limit orders execute the trade order at a fixed price once the price reaches set limit.

- Create order groups (OCO) where all the orders are cancelled if one of the orders is successfully completed

Manual Trading with Smart Trade

Smart Trade terminals allow investors to trade crypto pairs on various exchanges. It lets users do manual trading using tools like smart cover, trailing stop loss, trailing take profit, smart buy, TradeView signals, stop-loss timeout, concurrent take profits and stop loss, etc.

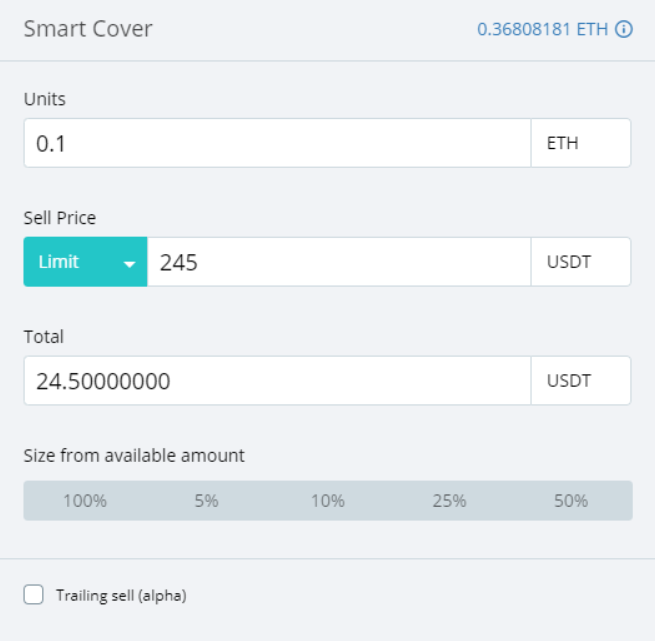

Smart Cover

This feature lets users sell their crypto coins and then re-buy them. The two scenarios where Smart Cover trade is definitely useful are:

- When users have long trade in positive and think the prices will drop soon, users can sell the coins at higher rates and then re-purchase them when the value goes down.

- When users hold assets that have dropping value, they can sell them and re-buy it for lower rates, basically, traditional short.

Trailing Take Profit

The Trailing Take Profit (TTP) function focuses on increasing the profits users can make off their trade. Investors set the TTP percentage and the trailing activates. Whenever the market price reaches or goes above the set limit, the system executes the transaction.

For example; An investor buys XRP for $100 and sets the TTP of +20%, that is $120. Suppose the value of XRP starts increasing and as soon as it hits the $120 benchmark; the system will close the trade transactions.

Trailing Stop Loss

This feature enables users to follow the uptrend of cryptocurrencies and is an effective way to minimize the losses.

Traders set Stop Loss and activate the trailing feature. The system follows this predetermined limit and automatically adjusts it whenever the market price hits a new high.

For example; Let’s assume Trailing Stop Loss (TSL) is set to $160 and the initial trade amount is $200.

Now suppose the following situations:

- The price goes up to $210, TSL is adjusted to $170 ($210 – $200 = $10)

- The price goes down to $205, nothing happens.

- The price moves up to $220, TSL adjusts to $180 ($220 – $210 = $10)

- TSL keeps on adjusting until trade is completed

Stop Loss Timeout

Stop Loss Timeout is an exclusive functionality offered by 3Commas. It basically delays the closing of trade by the specific time when the prices drop to or below the predetermined Stop Loss limit set by users.

The feature works wonders when the price of assets fall and rise back up within a few minutes or when you experience what we call “fake-outs” in crypto slang. To make sure your trade goes through when price actually dips, one can use this feature.

Smart Buy

The Smart Buy functionality was recently added to the platform which is specifically for traders that have open short positions on Futures exchanges. It is also helpful for investors that want to take control over their Futures from 3Commas but made positions over other exchanges.

Concurrent Take Profits & Stop Loss

Traders can simultaneously buy and sell their crypto assets by defining the Take Profits (TP) percentage and Stop Loss (SL) limit. The trade deal goes through when the market prices reach the set TP limit or when it drops to or below the SL limit.

TradingView Signals

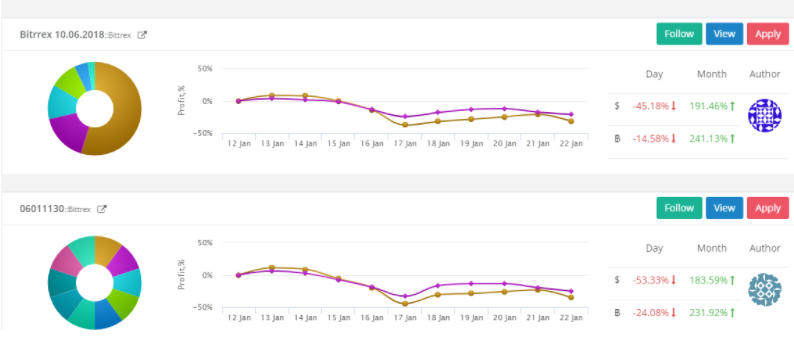

The trading signals are basically triggers that call for some type of action to be taken, be it selling, buying or exchanging of the crypto funds and trading pairs. The signals are generated by the help of algorithms and strategies created by the signal providers.

Users can subscribe to signal providers and create bots with the recommended settings. The signal providers can offer their services for free or might charge some fee. They can differ in parameters like the exchanges and trading pairs they use, positions they offer that are long or/and short, provide options for Take Profits or Stop Loss or not, etc.

Automated Trading Bots

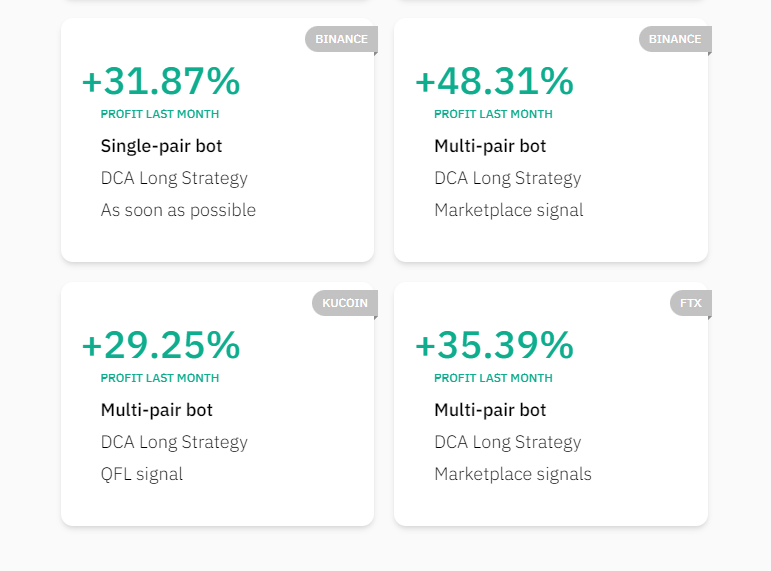

3commas provide automated trading bots which allows investors to test or trade their strategies and once set and trained can perform profitable deals for a long run.

3Commas traders can use bots based on different strategies; three types of bots offered are Grid, Dollar-cost averaging (DCA) and Options Bots.

Dollar Cost Averaging Bots

3Commas offer two bots, namely, “Gordon” bot and the “Advanced” created on the DCA strategies. The strategy is to basically invest in cryptocurrency at already set intervals at different prices by dividing your initial investment funds into smaller parts.

This ensures a better average price for your position while reducing and minimizing the losses that occur from volatility. It also offers various presets for DCA bots. The complete step-by-step guide on how to create bots are present on 3commas’ Knowledge Base.

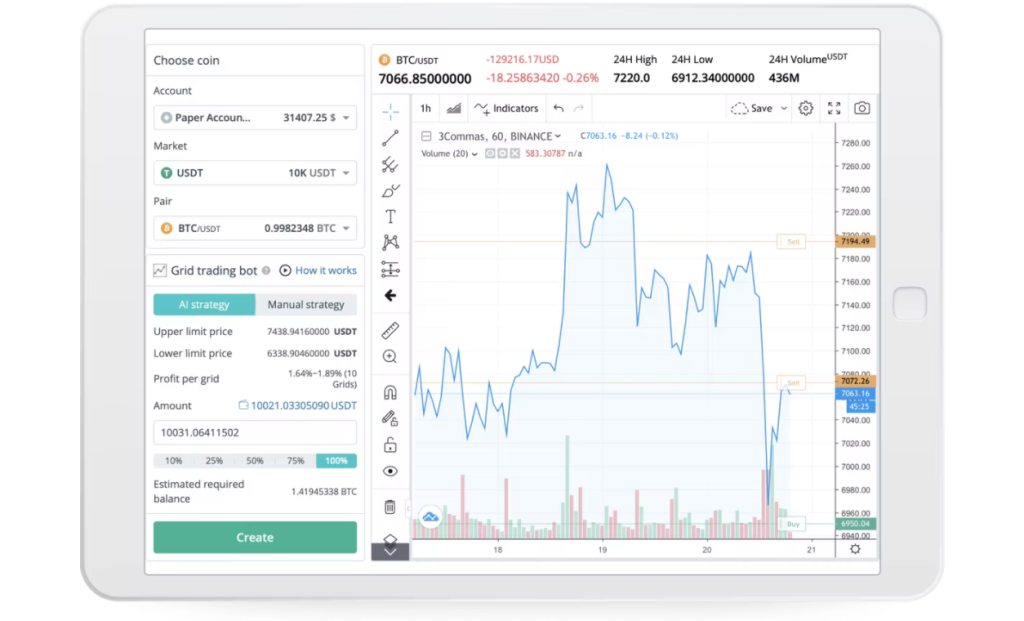

Grid Bots

Grid Bots are a new addition to the 3Commas Bot family and work effectively when trading with the cryptocurrencies that are without trend and do not move in any clear direction, often known as moving sideways. To state it simply, these bots create a series of buy and sell sideways stats and start generating profits whenever the price moves around the grid.

Options Bots

The bots work with options which is basically a contract between a buyer and a seller. 3Commas offer two options on BTC and ETH as the underlying assets which are A Call Option and A Put Option.

A Call Option: Gives the option buyer the right to purchase the underlying assets at a set price.

A Put Option: Gives the option buyer the right to sell the assets at a set price.

Portfolio

Portfolio attributes allow traders to link their 3Commas account with exchanges to consolidate their crypto funds from all the platforms at one place. It grants users the access to sync the balance, save, copy and change the portfolios.

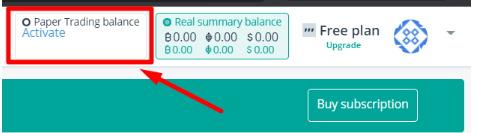

Paper Trading

The paper trading feature replicates the actual crypto market and provides stimulated virtual funds to users for trading purposes. This helps traders to get familiar with platform and crypto markets without actually having to risk their money.

The paper trading account is separate from the live account and investors get 10, 000 USDT, 300 BNB, 50 ETH and 1 BTC as account balance. The platform however, charges 0.1% per order and the total number of orders that can be placed in total are 100.

3Commas eWallet

3Commas wallet lets traders store, sell, buy, manage and exchange cryptocurrencies. It supports over 45 major blockchains with dozens of stablecoins and over a thousand crypto tokens. Some of the supported cryptocurrencies are Bitcoin, Uniswap, Ethereum, Tezos, Tether, etc.

Customer Support

Customers can use and assist the Knowledge Base which consists of a number of articles regarding their services. 3Commas also offers Academy features through which one can learn more about crypto and its volatile market.

The company offers mail support and social communities like telegram and discord.

3Commas Pros & Cons

Pros

- The automated trading bots can be made from scratch or by copying other traders’ algorithmic code to generate profits.

- The subscription plans are affordable in comparison to its competitors.

- Offers a mobile application and has EWallet services.

- Have extensive educational resources on their site.

- Offer great functionalities like portfolio, paper trading, smart trade, etc.

Cons

- Supports a limited number of crypto exchanges.

- Beginners can find tools a little complex to use.

3Commas Review: Summary

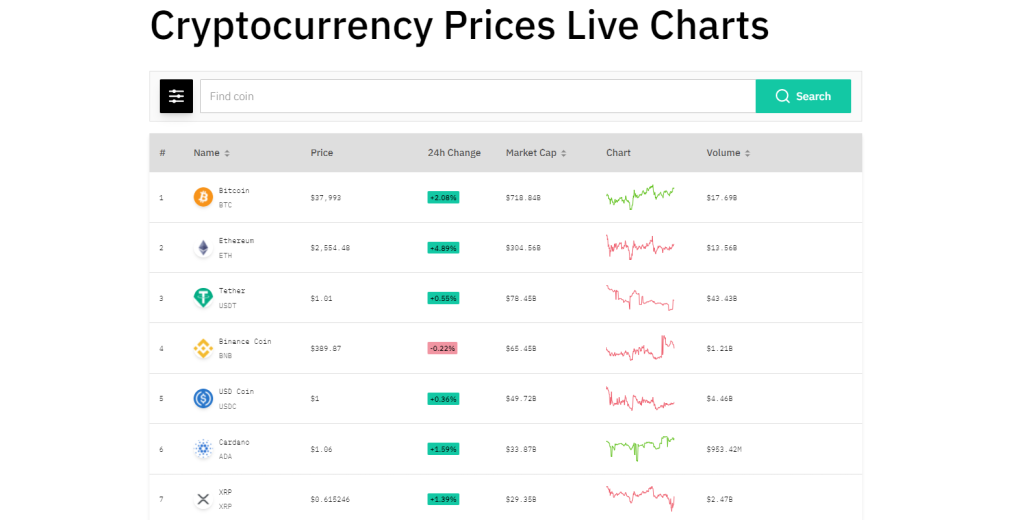

- 3Commas offers an easy to use trading interface, live crypto charts, Smart Trade options like Take profits and Stop Loss trailing, concurrent TP & SL, OCO, Smart Cover, Paper trading, etc.

- It offers four subscription plans that can range from $0 to $45.5 on a yearly basis.

- It currently supports 18 exchanges and over a thousand cryptocurrencies.

- It provides documentation concerning various topics, and customer support through email and virtual communities.

FAQs

Q1. Can I use 3Commas with Coinbase?

Q2. How much is 3Commas?

Also Read: